Trinity Flex I Annuity

The Advantages of Trinity Flex I Annuity…

Trinity Flex I is a flexible premium annuity that enables you to make choices about the amount and frequency of your premium deposits. During the accumulation period, premium deposits earn current interest that is tax deferred until withdrawn or paid as a claim.

SMALL PREMIUMS

You can start your Trinity Flex I with as little as a $5,000 single premium deposit. Once issued you may add as little as $25 a month. This modest minimum premium payment provides individuals with an opportunity to begin enjoying the benefits of fixed annuities, without a large up-front commitment of resources.

COMPETITIVE INTEREST RATE

Trinity Life Insurance Company has a proud history of paying competitive interest rates. The interest rate you receive at issue is guaranteed for the first year of your annuity contract. After that, you will benefit from competitive renewal rates based on the current interest rate environment and current market conditions. The Company will declare a new interest rate which is guaranteed for that contract year. In addition, the interest rate is guaranteed to never go below the contractual minimum guaranteed rate!

NO MARKET RISK

Your Trinity Flex I can provide you with peace of mind, knowing that fluctuations in the stock or bond markets cannot cause you to lose principal. This safety of principal is one feature that makes fixed annuities a valuable addition to many retirement plans.

TAX DEFERRED GROWTH

Premium payments to your Trinity Flex I grow tax deferred during the accumulation period, allowing you to earn interest on funds that you would otherwise have paid as taxes. For annuities, lump sum withdrawals or periodic free withdrawals may be subject to federal income taxes equal to the amount of interest withdrawn and may be subject to an additional tax penalty if the owner is under age 591/2.

THE FACTS

$10,000 Premium

Taxable Growth (28% Tax Bracket) – 5%

Tax Deferred Growth – 5%

If the entire annuity balance was withdrawn at the end of 10, 20 or 30 years the chart above shows the advantage a tax deferred account can provide compared to a taxable account assuming 5% interest rate and 28% tax bracket.

FREE WITHDRAWAL PRIVILEGE

If liquidity is a concern, then you may want to take advantage of the 15% free withdrawal feature of the Trinity Flex I. It offers you penalty-free withdrawals for as much as 15% of your annuity value each contract year. You may take these free withdrawal(s) either as a lump sum or periodic payments.

INTEREST INCOME OPTION

Your Trinity Flex I gives you the ability to choose how and when you would like to receive your interest income. Just tell Trinity Life Insurance Company how often you would like to receive your interest payment, and where you would like it sent. We provide you this free, personalized service to help make owning a Trinity Flex I convenient and simple.

PAYOUT OPTIONS

You may elect to receive your annuity value in a lump sum or from one of the many settlement options contained in your contract. Options include life annuity, life annuity with a period certain, payments for a designated period, payments of a specified amount or interest income. Trinity Flex I allows you to choose which option best suits your needs.

EXTENDED CARE BENEFIT

Your Trinity Flex I provides that if, per doctor’s orders, you are confined to a hospital or qualifying extended care facility for a period of 30 days or longer, you the owner, may have access to funds in your annuity in excess of the 15% free withdrawal amount without incurring any early withdrawal charge. This benefit is offered to individuals up to age 75 at issue, and may allow you to withdraw the lesser of $10,000 or 25% of the annuity value.

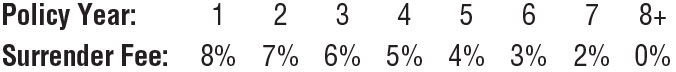

EARLY WITHDRAWAL FEES

Because fixed annuities are designed for retirement planning, early withdrawals may incur surrender penalties. If anytime during a contract year, you choose to take out more than the 15% annual penalty-free withdrawal, the Trinity Flex I assesses the following surrender fees:

Annuities are insurance contracts and are not guaranteed by any bank, nor insured by the FDIC.

Early withdrawals are subject to withdrawal fees and, if made prior to age 591/2, the taxable amount may be subject to a 10% federal income tax penalty.

Penalty-free access during grace periods only.

Questions?

Send us your Trinity Flex I Annuity Questions